Here’s one we’ve heard recently: “Did CMHC’s MLI Select program change their requirements, and When did that happen?”

If you’ve been looking into financing for multi-unit residential projects in Canada, you’ve probably come across the CMHC MLI Select program, and you might have noticed that it’s not quite the same as it used to be after changes came into effect in June of 2024.

We’ve had questions on this recently from developers, and investors trying to make sense of the updated rules. So, let’s break it down.

What is CMHC MLI Select?

The Multi-Unit Mortgage Loan Insurance (MLI Select) program from Canada Mortgage and Housing Corporation (CMHC) is designed to support the construction, purchase, or refinancing of multi-unit residential buildings that meet certain social, environmental, or accessibility criteria.

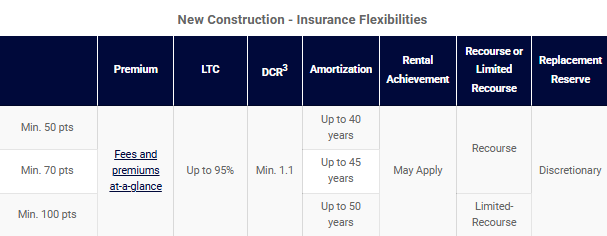

Basically, it rewards projects (based on a points system) that can prove superior energy efficiency, affordability, and/or accessibility with better financing terms. These preferred terms are thing like lower premiums, longer amortizations, or higher loan-to-value ratios.

See below for the insurance flexibilities provided based on points earned in the program:

How It Used to Work

Previous to the June 2024 program rule revisions, projects could qualify for the maximum 100 points by focusing solely on energy efficiency.

That meant developers could achieve full lending advantages simply by hitting the right efficiency targets through upgrades such as:

- Installing high efficiency HVAC systems, like heat pumps

- Improved insulation

- Installing high-performance windows

- Replacing inefficient water heating systems

- Installing solar panels (though this is only allowed to make up 15% of the required annual energy consumption reduction)

At the time, this made the program quite accessible for investors and developers focused purely on performance and Step Code compliance.

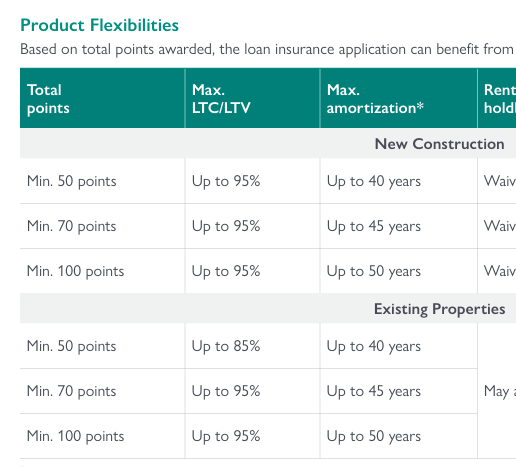

Below is a CMHC list of the PREVIOUS program requirements on the left, along with the points rewards table on the right:

How It Works Now

That has changed.

Under the updated MLI Select framework, projects can no longer reach the full 100-point benefit level through energy efficiency measures alone.

Now, to reach the top tier, projects must combine two or more pathways, unless using the affordability criteria – for example:

- Energy Efficiency and Affordability, or

- Accessibility and Affordability

- Energy Efficiency, Affordability and Accessibility

This shift ensures that projects not only perform well environmentally, but also provide long-term social benefits such as housing affordability and accessibility.

For many investors and developers, this has added a new layer of planning and complexity, but CMHC’s MLI Select remains an excellent program when structured properly.

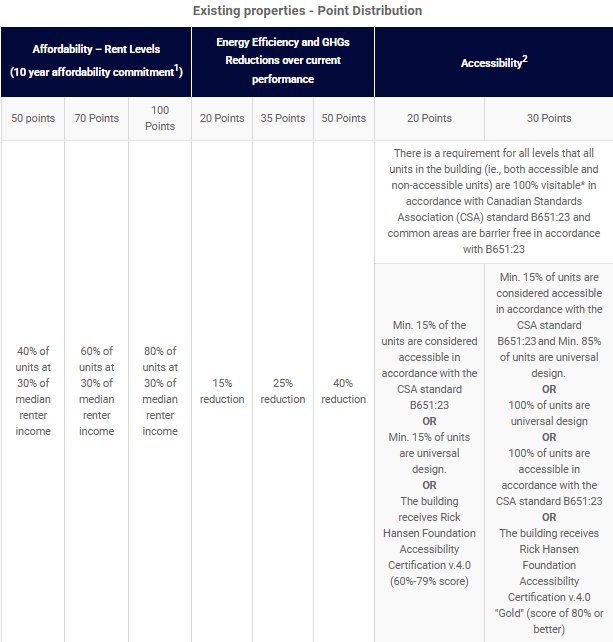

See table below for the updated breakdown of points available by category since program rules changed in June 2024:

Of note: Affordability can reach the 100 point requirement for improved lending benefits as a single category

Energy Efficiency and Affordability can be combined to reach 100 points

Affordability and Accessibility can be combined to reach 100 points

Energy Efficiency and Accessibility can be combined to reach a maximum of 80 points

Thrive Energy’s Experience with MLI Select

We’ve worked on both new construction and existing building projects under the MLI Select program, including four existing-building projects, as well as one new construction project.

Recently, we also took over a project started by another company where the investor was left stranded. Their original Energy Advisor had gone silent when the Post-Upgrade reports were due. This is a concern, because without the Baseline Energy Model to work off of, the Upgrade Reports cannot be completed unless the Baseline work is re-done.

Because MLI Select energy models are not submitted to NRCan, they can’t simply be pulled from the NRCan database like a traditional EnerGuide file. That makes it particularly difficult to step into someone else’s project after the fact and especially when the Energy Advisor is irresponsive to phone calls and emails.

In this case, we were able to obtain all the necessary baseline data directly from the investor, rebuild the energy model from the ground up, and complete the upgrade model and reports required by CMHC. This allowed the investor to submit all required documentation before the CMHC deadline. PHEW.

I sincerely hope this isn’t happening to anyone else, but if you’re reading this and find yourself in a similar situation, please reach out to us.

The Takeaway

The MLI Select program remains one of Canada’s most powerful tools for supporting energy-efficient, affordable multi-unit housing, but the rules have evolved.

If you’re planning to apply or you’ve inherited a project mid-process, get expert guidance early to avoid delays or lost lending benefits.

At Thrive Energy, we’ve guided multiple builders, developers and investors through both existing building and new construction MLI Select files, and we understand what CMHC expectations are.

See information directly from CMHC on their MLI Select Program here.

Got questions? Email, call, text.

Email: brett@thriveenergyinc.com

Phone: 778.867.0242

Website: www.thriveenergyinc.com