Canada Greener Homes Loan BC

Interest-Free Financing for Energy-Efficient Home Upgrades in British Columbia

The Canada Greener Homes Loan Program offers homeowners in British Columbia up to $40,000 in interest-free financing over a 10-year term to support eligible energy efficiency upgrades.

This program is designed to help Canadians improve home comfort, reduce energy use, and lower emissions while spreading upgrade costs over time with no interest.

What Is the Canada Greener Homes Loan?

The Canada Greener Homes Loan is a federal interest-free loan program that helps homeowners complete approved energy efficiency retrofits.

Funds can be used for a wide range of upgrades, including:

- Heat pumps and high-efficiency heating systems

- Solar panels and battery storage

- Insulation upgrades (attic, walls, basements)

- High-performance windows and doors

- Air sealing and ventilation improvements

The loan is interest-free, with repayment spread over 10 years.

Loan Amount & Terms

- Borrow between $5,000 and $40,000

- 0% interest with a 10-year repayment term

- Loan amount is based on approved retrofit quotes

- Costs are capped to market-aligned standards

- Homeowners are responsible for the upfront cost of:

Pre-retrofit EnerGuide evaluation

Post-retrofit EnerGuide evaluation

General Eligibility Requirements

Qualifications

To qualify for the Canada Greener Homes Loan, homeowners must meet all program requirements:

- Own and live in the home as a primary residence

- Complete a pre-retrofit EnerGuide evaluation

- Meet credit eligibility requirements

- Not start retrofit work before submitting an application

- Limit of one loan per property

Applications submitted after retrofit work has started are not eligible. Program rules and eligibility requirements are subject to change.

Low-Rise Multi-Unit Residential Buildings (MURBs)

Homeowners living in eligible low-rise multi-unit residential buildings (MURBs) may qualify for the loan, provided they meet all individual eligibility criteria.

Additional requirements may apply to ensure that upgrades contribute to the overall energy performance of the building. Eligibility can vary depending on ownership structure and retrofit scope.

It’s recommended to confirm eligibility with a qualified energy advisor before proceeding.

Northern and Off-Grid Communities

Homeowners in northern and off-grid communities may qualify for enhanced program support, including:

- Up to 30% more funding per eligible retrofit measure

- Higher upfront loan advances to support contractor deposits

- Special allowances for:

- Fossil fuel system replacement

- Increased insulation requirements due to climate conditions

Eligibility is location-based. Homeowners should check their postal code to confirm qualification.

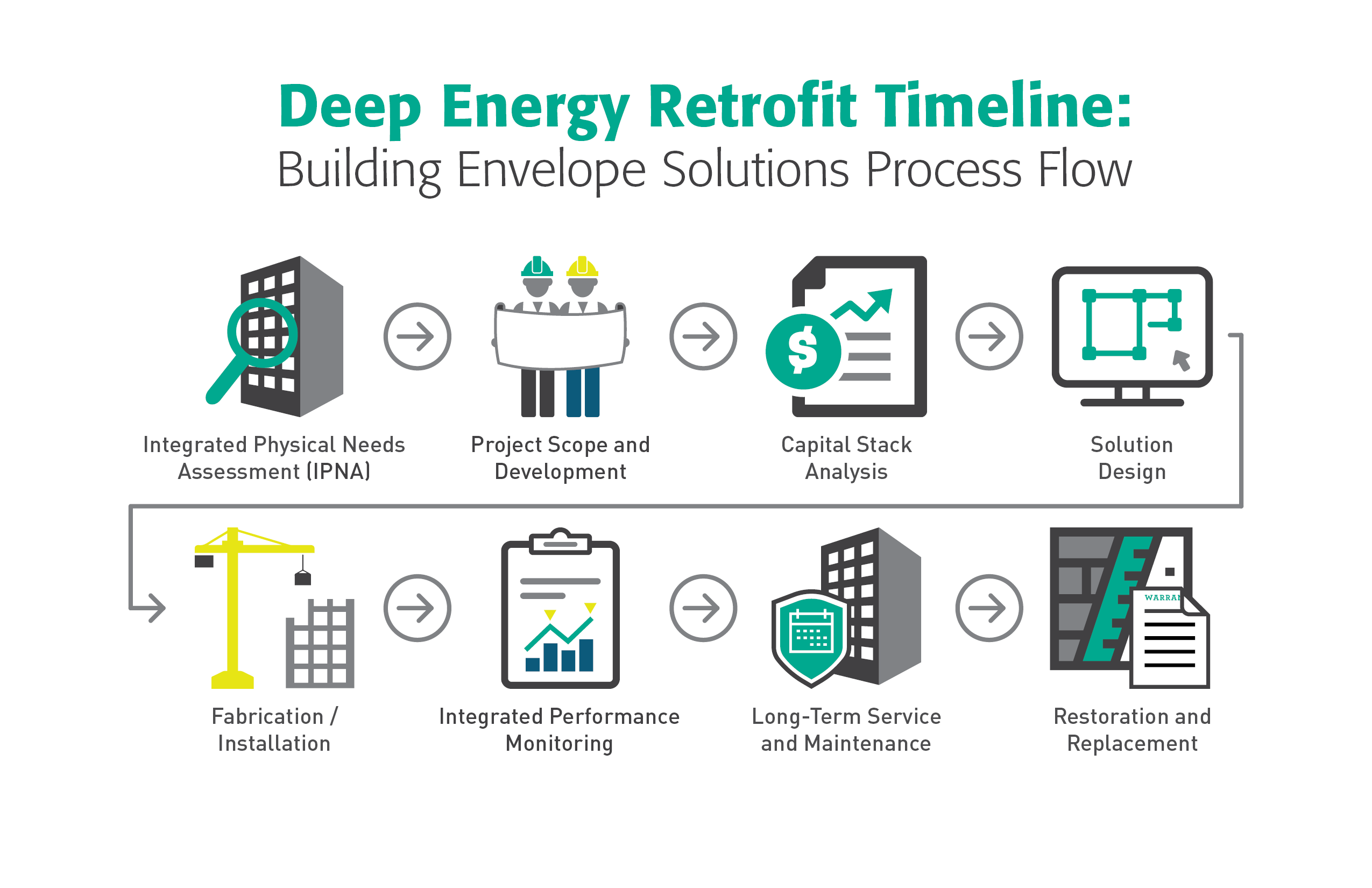

Step-by-Step Planning for Success

Pre-Retrofit EnerGuide Evaluation

The process begins with a pre-retrofit EnerGuide home evaluation. During this site visit, we gather the information required to create an accurate energy model and identify eligible upgrade recommendations.

This evaluation is the foundation for:

- Loan eligibility

- Retrofit planning

- Rebate and financing coordination

Do Not Start Work Before Applying

Retrofit work must not begin before:

- The pre-retrofit evaluation is completed, and

- The loan application is submitted

Starting work early will make the project ineligible for loan funding.

3. Loan Approval & Credit Review

The Greener Homes Loan is secured and subject to a credit review. Approval is based on the homeowner’s financial standing at the time of application.

Options such as adding a co-borrower may be available if required.

Additional Tips & Support

Loan Details & Upfront Costs

- Up to 15% of the loan may be released upfront

- Up to 25% upfront for northern and off-grid communities

- Intended to help cover contractor deposits

- Final funding is released after:

- Approved upgrades are completed

- A post-retrofit EnerGuide evaluation is submitted

Step-by-Step Application Process

Submitting a complete and accurate application helps avoid delays.

Key steps include:

Schedule a pre-retrofit EnerGuide evaluation

Plan eligible retrofit upgrades

Submit the Greener Homes Loan application

Complete approved upgrades

Schedule the post-retrofit evaluation

Request final loan funding

Begin the 10-year repayment term

FAQs

Who is eligible for the Canada Greener Homes Loan in BC?

Canadian citizens, permanent residents, or eligible residents with legal status who own and live in the home as a primary residence and complete a pre-retrofit EnerGuide evaluation.

How much can I borrow through the loan?

Between $5,000 and $40,000, interest-free, with a 10-year repayment term.

Can I receive money upfront to pay a contractor deposit?

Yes. Up to 15% upfront, or 25% for northern and off-grid communities.

What types of upgrades are eligible?

Eligible upgrades typically include heat pumps, insulation, windows and doors, solar and battery storage, air sealing, and ventilation—when recommended in your EnerGuide evaluation.

Can I apply if I’ve already started retrofit work?

No. Work must not begin before submitting your loan application.

Do Indigenous homeowners have different requirements?

Yes. Indigenous applicants may register multiple homes, and homes do not need to be primary residences. Additional supports may apply.

What documents are required to apply?

Common requirements include:

- Government-issued photo ID

- Proof of income (e.g., pay stub)

- Contractor quotes

- Pre-retrofit evaluation file number

- Property tax bill

Ready to Make Your Home Greener?

The Canada Greener Homes Loan makes it easier to plan energy-efficient upgrades while spreading costs over time when the process is followed correctly.

Whether you live in a city, a multi-unit building, or a northern or off-grid community, we’ll help guide you through the first step.